(Click image to enlarge)

How willing one is to give of oneself

The combination of

Assets, that which is owned outright, and Debt, that which is borrowed

leveraging Assets, can yield a supply of money that can be used for making more

money, Investing.

If a person has few assets, Lo, and is reluctant to

borrow, Lo, he is a Miser and his money supply will likely be insufficient to

create income.

If a person borrows excessively on his assets (Hi) but

his assets remain Lo, his Liberal tendency can become problematic.

If a person has Hi assets but refuses to borrow on them,

his Conservative tendency will hold him in check.

The right mix of Assets and Borrowing, where

borrowing adds to assets, gets the

successful result, a Winner.

The dark circle in the grid is a subjective evaluation

of where the investor is at this time in his quest for success; it should be

dated and revised from time to time when revision is indicated.

Identifying the means of investing is a necessary step

in the process of creating wealth and success depends on increasing Confidence

through Practice.

When both are Lo the choices may seem Childish when

reviewed from a more knowledgeable point of view.

When Confidence is Hi and Practice Lo, the resulting

choices are those of a clown who is not taking the situation seriously.

When Practice is Hi and Confidence Lo, the results may

be losses whose lessons go unheeded.

When Practice and Confidence are Hi, the results yield

the pleasure that comes with success.

The Dark Circle indicates where one is on the review

date and this should be updated from time to time.

In order to be successful investing, one has to follow a

strategy and tactics; this can be termed a Buy/Sell Scheme.

As with getting results, the two determinants ate

Practice and Confidence. The evolution

of the scheme occurs with practice; as the scheme is proven, confidence grows.

When both are Lo, one can expect losses until the scheme

is perfected.

Then as Practice moves toHi,

Confidence may remain low and with a proven scheme the results will be

break-even or better.

If the scheme is good but the application of it is

willy-nilly, in other words, if Confidence is Hi but Practice is Lo, one can

expect the losses to continue.

When Confidence and Practice are Hi, the expectation is

Profits.

As with all of these, the current situation is marked by

the filled circle with the date the assessment is made.

Any business venture needs to have a Tracking System for

measuring, assessing, and reporting Results.

Any system must be understandable and allow for recall of pertinent data

that will allow these.

If Knowledge and Recall are Lo, the system is Risky in

that it may not give the required data.

If Knowledge is Hi but Recall is Lo, the system is

probably too complicated to be useful.

If Recall is Hi but Knowledge is Lo, the system may

yield data that doesn’t truly represent what is happening, Delusional.

If Knowledge and Recall are Hi, the system is fulfilling

the purpose and reliable information is the yield.

As with all of these, the current situation is marked by

the filled circle with the date the assessment is made.

Acquisitions are mostly acquired by purchasing

them. There is a process that is

followed in order to acquire valuable assets.

The acquisition must be identified and then the purchase

negotiated. The source of the

acquisition and often dictates the degree of negotiation available. Of course, anything can be negotiated but

there is a framework in place.

Retail is generally the source of shopped acquisition

and the level of negotiation is usually Lo; Identification is limited to what

is shown by the dealer.

Internet is Retail expanded and one can identify many

sources of a type of acquisition sought, the level of negotion is

usually Lo.

The Private Deal is likewise limited to what is offered

but negotiation is Hi as an understanding is reached.

The Marketplace is like a trading floor where buyers and

sellers come together the transaction approaches Auction.

Where are you now? The current situation is marked by the filled circle

with the date the assessment is made.

The age-old advice in stock investment is. “Buy low,

sell high.” The inside of that advice is

a strategy is finding good stocks to own and then when to hold them and when to

sell them. If the Price-Earning ratio is

Lo and the stock has potential but has not been discovered by the market, the

action is to Buy.

As the stock is discovered but the P/E Ration remains

Lo, it is prudent to hold the stock.

But if the P/E ratio increases, discovered or not, the

optimum thing to do is to Sell the stock and profit from the transaction.

This strategy is best applied to companies that are not

paying dividends but investing profits back into growth.

The current situation is marked by the filled circle

with the date the assessment is made.

One of the most intriguing aspects of investing is the

Buy/Sell strategy. The “hold” option

often touted as being the best is just as often not the best. One must adopt a completely objective view of

the investment, make it, then monitor the activity until it is prudent to sell.

If one lookes at

Holding Time and Value, one can label the various scenarios accurately. If the value increase is Lo and the Holding

Time Lo, it can be said that the investor is being speculative.

If Value remains Lo and Holding Time bcomes Hi, the

investor has become passive, i.e. not paying attention.

If the Value increases to Hi during a Lo, or short,

Holding Time, the investor has been the recipient of luck, tantamount to

winning the Lottery.

If the Holding Time and Value are both Hi, the analysis

done by the investor is validated and the investor can consider him/herself

successful.

The current situation is marked by the filled circle

with the date the assessment is made.

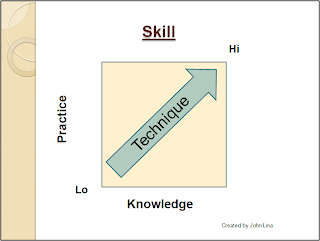

Asset appreciation applies to investments of all sorts,

stocks, collectibles, art, real estate, even inventory. Being able to find and invest is a function

of knowledge and experience.

It would behoove one to become a professional in a

market, where a market is defined as a “family” of assets. As Knowledge and Experience grow from Lo to

Hi, the investor passes through various stages from Amateur, to Student, to

Technician, to Professional.

The difference between Technician and Professional is a

blend of the two factors that allows judgment based on more than the result of

applying analytical tools.

Participating in a market also requires work along three

lines: the first line is on oneself, to acquire objective knowledge, the second

is with others of like mind to develop that knowledge and temper it with shared

experience, the third is work to advance the market itself.

The current situation is marked by the filled circle

with the date the assessment is made.

The Risk of Loss associated with investing in

appreciating assets generally increases with how long the asset is held. An examination of the scatter chart above

shows the comparison of Investment Value and Time held and the increasing Risk

of Loss.

The chart would indicate a certain pessimism but then a

wise investor is always capable of taking both view, the pessimistic and the

optimistic. He/she generally invests

with an optimistic view but watches and acts with due weight given to the

pessimistic.

After acting the slate is erased clean and the cycle

starts over again.

The general theory is that investments increase in value

over time. This is not always the case

and one must have an objective view of the market in which he/she is investing.

Find the type of investment being considered and look at

the possibility for Return on Investment (ROI).

When considering investments, carrying costs need to be factored and

offset the rise in value. For example,

with land there are taxes, with Real Estate, other than your residence there is

maintenance and taxes, with precious metals and art there is safe storage to be

considered, with animals there are other risks such as disease and death to be

considered.

The risk of loss involved with trading in assets, which

can be improved by adding value to them, ranges, depends on the type of asset

involved and the useful life of that asset.

When the Investment or Value is Lo, considering leverage

upon acquiring the asset (the amount of money put up by the buyer compared to

the amount borrowed to purchase) the risk of loss is Lo because objective

others deem the value to be well founded.

For depreciating assets, such as animals and equipment the risk of loss

is Hi; Land and Artwork usually requires a Hi investment but the risk of loss

is lower; the surety of gain is likewise

lower.

Wise investing, i.e., knowing market and maintaining an

objective judgment of assets acquired for investment is a basic pre-requisite

for success in Value Added Asset investments.

Value Added Assets tend to increase in value over time

and the Return on Investment is calculated on the capital that the investor has

to use in acquisition. Since the amount

of capital is the investment for the purpose of calculating ROI, the leverage

that is available has a large effect.

Land, Art, and Animals have less value when used as collateral for

investment than do Real Estate and Equipment and, therefore, tend to have a

lower ROI.

The exception is that one tract of land that becomes

essential as a building site or that animal is discovered to have a

peerless bloodline.

The cost of owning an asset has to be considered prior

to making the investment. The same

factors affect the Investment as in previous discussions but it has to be noted

that holding some assets require considerable expense.

The category “Junk” is added here to make the point that

there are some assets that require less in terms of Investment and have almost no

Carrying Cost. Other assets should be

judged for their relative carrying cost comparing them to the lowest.

The most serious piece of advice one can take to heart

is that of objectivity. The ability to

look at an investment without emotional attachment when buying and, or more

importantly, selling it. If a person

remains flexible in his opinion and objective in his reasoning, then he or she

will be a winner in the investment game.

It can be seen that when Objectivity and Flexibility or

Lo the situation is one of a forced action, usually a sell. The other quadrants are intuitively obvious

to the casual observer.

The current

situation is marked by the filled circle with the date the assessment is

made. In this sense, it is important to

have a checklist of measurable items to determine one’s current situation. Emotional reactions are sometimes difficult

to recognize otherwise.

The most serious piece of advice one can take to heart

is that of objectivity. The ability to

look at an investment without emotional attachment when buying and, or more

importantly, selling it. If a person

remains flexible in his opinion and objective in his reasoning, then he or she

will be a winner in the investment game.

It can be seen that when Objectivity and Flexibility or

Lo the situation is one of a forced action, usually a sell. The other quadrants are intuitively obvious

to the casual observer.

The current

situation is marked by the filled circle with the date the assessment is

made. In this sense, it is important to

have a checklist of measurable items to determine one’s current situation.

Emotional reactions are sometimes difficult

to recognize otherwise.